Succentrix Business Advisors for Dummies

Table of ContentsGet This Report about Succentrix Business AdvisorsSuccentrix Business Advisors for BeginnersOur Succentrix Business Advisors DiariesSuccentrix Business Advisors for DummiesThe smart Trick of Succentrix Business Advisors That Nobody is Talking About

That's where these accountants come in. Inner auditing provides management and the board of directors with a value-added service where imperfections in a procedure may be caught and dealt with. This is very important for securing firms from liability for scams too. The Sarbanes-Oxley Act of 2002 - https://triberr.com/succentrix established brand-new corporate accounting criteria and enforced extreme criminal fines for economic scamsTax accountancy is likely the most usual accountancy service utilized by personal people. Tax obligation accountants focus on preparing tax returns and aiding people and businesses file their types and pay their taxes. Tax obligation regulation is constantly made complex and constantly changing, so accounting professionals have to remain up-to-date on every one of the policies and guidelines.

A skilled accounting professional will certainly understand every tax obligation deduction a person can claim and every credit score they're eligible for. These accountants aid individuals keep their tax obligation costs low. Forensic audit is concerning examination and lawsuits support. This solution is generally involved with legal actions and allegations of scams, embezzlement, or money laundering.

Succentrix Business Advisors for Dummies

Accounting is concerning maintaining precise and detailed records. This is the support of audit. Without information gathered by accounting, accounting professionals have nothing to collaborate with. Professional Accounting and Tax services. Record keeping for small companies can offer a now snapshot of a company's financial circumstance and health. It involves keeping track of all inputs and outcomes and double-checking whatever to see to it it's been appropriately taped.

When it's time to file for taxes or apply for a funding, a bookkeeper can produce a financial declaration simply by placing together the monetary records for a given period of time. Among the factors professional bookkeeping services are so crucial is due to human mistake. Any kind of process run by individuals is going to make blunders.

You process settlements and after that down payment those repayments in the bank. If your documents are precise, your repayment records ought to flawlessly match the bank's record of down payments.

The Basic Principles Of Succentrix Business Advisors

Accounts payable is a group that consists of future expenses as well, which helps you plan. Professional Accounting and Tax services.

You might not be able to receive that cash immediately, yet you can prepare future expenses based on the anticipated in-flows from those balance dues. The classification of receivables on a basic journal is vital due to the fact that it allows you look ahead and plan. The more educated you have to do with your business's financial circumstance, the far better prepared you are to change and adapt as required.

Handling a regular payroll and documents can take up a great deal of time and initiative, also tax advisory services for a tiny organization without as well many workers. Accountancy services concerning payroll can include gathering staff member information, establishing a time-tracking system, and managing the real handling of settlements to staff.

Things about Succentrix Business Advisors

Lots of business owners collaborate with accountants as they produce service plans, also before the business has been developed (Professional Accounting and Tax services). Accountants can be valuable companions in developing a compelling company strategy and critical which service entity is best for the proprietor's vision. Accountants can assist a local business owner clear up on a firm name, collect company details, register for a company recognition number, and register their company with the state

Accountancy solutions are about enhancing record procedures and generating data to equip you far better to expand your business and realize your vision.

The 5-Second Trick For Succentrix Business Advisors

The reality that many companies consist of the exact same conformity summary on client billings reinforces that there is second best concerning the conformity record. Conversely, the suggestions, competence, planning and approach that went into the process before the record was developed are extremely separated. Advisory solutions grow from our one-of-a-kind experiences and competence, and are the secret sauce that creates worth for our clients.

Advisory supports specialization, which causes higher-value solutions and separation from the sea of generalists. However, if we can't verbalize our advising expertise, it's a certainty that customers won't be able to untangle our conformity services from higher-value consultatory services. The AICPA specifies consultatory services as those solutions where the practitioner "creates searchings for, verdicts, and referrals for customer factor to consider and decision making." AICPA additionally gives instances of consultatory services that consist of "a functional testimonial and improvement study, analysis of an audit system, aid with critical preparation, and interpretation of requirements for an info system." This is valuable, however this meaning feels much more official and narrower than just how specialists explain consultatory solutions in their companies.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Tia Carrere Then & Now!

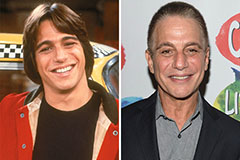

Tia Carrere Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!